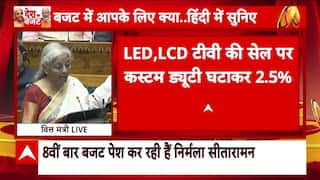

This year’s Budget will be Finance Minister Nirmala Sitharaman’s eighth Budget in a row. She has presented seven budgets till now, including an interim Budget in 2024. Stay tuned for our full coverage!

Ministry Budget Allocation (₹ crore)

| Ministry | 2023-24 (in Lakh Cr) | 2024-25 (in Lakh Cr) | 2025-26 (in Lakh Cr) | FY25 vs FY26 (%) |

|---|---|---|---|---|

| Defence | 5.94 | 6.22 | 6.81 | 9.53 |

| Road Transport And Highways | 2.76 | 2.78 | 2.87 | 3.35 |

| Home Affairs | 2 | 2.19 | 2.33 | 6.17 |

| Consumer Affairs, Food and Public Distribution | 2.11 | 2.05 | 2.15 | 4.75 |

| Education | 1.13 | 1.21 | 1.29 | 6.6 |

| Health | 0.89 | 0.87 | 0.99 | 13.92 |

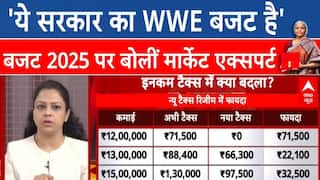

Income Tax Slabs

| Tax Rate | Old Regime (Amount in Lakh) | New Regime (FY26) |

|---|---|---|

| Nil | upto 2.5 L | upto 4 L |

| 5% | 2.5 L to 5 L | 4 L to 8 L |

| 10% | - | 8 L to 12 L |

| 15% | - | 12 L to 16 L |

| 20% | 5 L to 10 L | 16 L to 20 L |

| 25% | - | 20 L to 24 L |

| 30% | Above 10 L | Above 24 L |

- 20:33 (IST) Feb 01

Budget Will Help Boost Participation Of Women In Economy, Says FORCES Executive

- 20:05 (IST) Feb 01

Budget Will Help Strengthen Electricity Distribution And Digitalise Power Sector, Says Executive

- 19:43 (IST) Feb 01

Budget Reforms Will Boost Entrepreneurship, Says Industry Executive

- 19:24 (IST) Feb 01

Budget 2025 Represents Change Of Gear, Says Tax Expert

- 18:58 (IST) Feb 01

Budget Reforms Will Ease Tax Burden On Homeowners, Says L&Y Homes India Founder

- 18:31 (IST) Feb 01

Budget 2025 Boosts Consumption-Driven Growth: Aditya Birla Sun Life CEO

- 18:01 (IST) Feb 01

Challenge Is To Cater To The Demands Of States, Says Sitharaman

- 17:53 (IST) Feb 01

We Trust Taxpayers, Says FM Nirmala Sitharaman

- 17:36 (IST) Feb 01

Budget 2025 Has Enhanced Healthcare Accessibility, Says TrioTree Tech CEO

- 17:20 (IST) Feb 01

Budget 2025 Is A Game-Changer For India's Entrepreneurs: MobiKwik's Bipin Preet Singh

- 16:47 (IST) Feb 01

The Rise In KCC Loan Limit To Rs 5 lakh Is A Huge Development In Budget 2025: Indian Overseas Bank's CEO

- 16:26 (IST) Feb 01

PM Modi Is Known For His Administration, Says Nirmala Sitharaman

- 16:15 (IST) Feb 01

Energy Security Got Special Attention In This Budget, Says Nirmala Sitharaman

- 16:01 (IST) Feb 01

Affordable Housing Push In Budget To Help Middle-Class Families, Says Industry Executive

- 15:47 (IST) Feb 01

Share Markets Settle Amidst High Volatility, Sensex Crosses 77,500, Nifty Closes Under 23,500

- 15:28 (IST) Feb 01

Budget's Focus On Healthcare Sector, Specially Cancer Care, Comes At A Crucial Time, Says ICICI Lombard CEO

- 14:54 (IST) Feb 01

Budget’s Emphasis On Tourism Will Significantly Boost India’s Hospitality Industry: Expert

- 14:44 (IST) Feb 01

'This Is The Budget Of Aspirations Of 140 Crore Indians': PM Modi

- 14:22 (IST) Feb 01

Budget 2025 Has Taken Crucial Steps To Strengthen Healthcare Ecosystem: Stance Health Co-Founder

- 14:00 (IST) Feb 01

Budget To Help Achieve Vision Of 'Insurance For All' By 2047, Says SBI General Insurance CEO

- 13:22 (IST) Feb 01

'AI-Driven Education Hubs Is A Commendable Step': Says Expert

- 13:03 (IST) Feb 01

'A Substantial Relief For Taxpayers': BankBazaar CEO On Update In New Income Tax Regime

- 12:39 (IST) Feb 01

Budget 2025 LIVE Updates: Total Receipts Projected For Rs 3.14 Lakhs In FY 2025 In Revised Estimates

- 12:21 (IST) Feb 01

Budget 2025 LIVE Updates: No Income Tax Till Rs 12.75 Lakh For Salaried Employees

- 12:09 (IST) Feb 01

Budget 2025 LIVE Updates: Tax Deduction On Interest For Senior Citizens Raised, TCS Removed For Educational Purposes

- 12:05 (IST) Feb 01

Budget 2025 LIVE Updates: New Income Tax Bill To Carry Spirit Of 'Nyay', Says FM

- 12:02 (IST) Feb 01

Budget 2025 LIVE Updates: Customs Duty Hike On Electronics, Reduced In Telecom

- 11:59 (IST) Feb 01

Budget 2025 FM Speech LIVE Updates: Reduction Of Custom Duty On Cobalt Powder, Lithium Ion Battery Scrap

- 11:57 (IST) Feb 01

Budget 2025 FM Speech LIVE Updates: 36 More Life Saving Drugs Fully Exempted From Basic Customs Duty

- 11:55 (IST) Feb 01

Budget 2025 FM Speech LIVE Updates: Rationalisation Of customs tariff structure

- 11:53 (IST) Feb 01

Budget 2025 FM Speech LIVE Updates: New Income Tax Bill To Be Introduced Next Week

- 11:48 (IST) Feb 01

Budget 2025 LIVE Updates: 100% FDI In Insurance Sector, Simplifying KYC Process

- 11:43 (IST) Feb 01

Budget 2025 LIVE Updates: Special Incentive For Bihar Including Greenfield Airports, Financial Support For Kosi Canal Project

- 11:40 (IST) Feb 01

Budget 2025 LIVE Updates: Enhanced Regional Connectivity To 120 New Destinations,

- 11:39 (IST) Feb 01

Budget 2025 LIVE Updates: Development Of Nuclear Energy, Ship Building Financial Assistance

- 11:36 (IST) Feb 01

Budget 2025 LIVE Updates: Urban Challenge Fund Of Rs 1 Lakh To Be Set Up

- 11:32 (IST) Feb 01

Budget 2025 LIVE Updates: Social Security Scheme For Welfare Of Gig Workers

- 11:45 (IST) Feb 01

Budget 2025 LIVE Updates: Expansion Of IITs, Additional Seats In Medical Colleges

- 11:27 (IST) Feb 01

Budget 2025 LIVE Updates: Broadband Facility To Govt Schools, Setting Up National Centre Of Excellence

- 11:25 (IST) Feb 01

Budget 2025 LIVE Updates: Setting Up National Institute Of Food Technology In Bihar

- 11:22 (IST) Feb 01

Budget 2025 LIVE Updates: Increasing Employment In Leather Sector, Scheme To Make India Global Hub For Toys

- 11:19 (IST) Feb 01

Budget 2025 LIVE Updates: Increased Credit Guarantee Cover For MSME, Startups

- 11:18 (IST) Feb 01

Budget 2025 LIVE Updates: Credit Card For Micro Industries With Rs 5 Lakh Limit

- 11:16 (IST) Feb 01

Budget 2025 LIVE Updates: Transformation of IndiaPost As Large Public Logisitcs

- 11:15 (IST) Feb 01

Budget 2025 LIVE Updates: Framework For Sustainable Harnessing Of Fisheries

- 11:13 (IST) Feb 01

Budget 2025 LIVE Updates: PM Dhan Dhaanya Krishi Yojana, 6-Year Mission for Aatmanirbharta In Pulses

- 11:08 (IST) Feb 01

Budget 2025 LIVE Updates: FM Sitharaman Lists 4 Powerful Engines Of Development

- 11:07 (IST) Feb 01

Budget 2025 LIVE Updates: Proposed Development Measures Span 10 Areas

- 11:05 (IST) Feb 01

Budget 2025 LIVE Updates: Budget Continues Our Efforts To Accelerate Growth: Sitharaman

- 11:04 (IST) Feb 01

Budget 2025 LIVE Updates: Sitharaman Begins Speech, Know What's In It For You — Watch Live

- 11:00 (IST) Feb 01

Budget 2025 LIVE Updates: PM Modi Says Budget For Common Man, Aspirations Of Poor, Farmers, Women And Youth

- 10:54 (IST) Feb 01

Budget 2025 LIVE Updates: Markets Climb Ahead Of Budget, Sensex Crosses 77,700, Nifty Tests 23,600

- 10:43 (IST) Feb 01

Budget 2025 LIVE Updates: Hope Good Environment Prevails In Parliament, Says Rijiju

- 10:41 (IST) Feb 01

Budget 2025 LIVE Updates: FM Sitharaman Receives Cabinet Approval, Speech To Begin Soon

- 10:46 (IST) Feb 01

Budget 2025 LIVE Updates: PM Modi, Amit Shah Reach Parliament, Cabinet Meeting Begins

- 10:26 (IST) Feb 01

Budget 2025 LIVE Updates — Whenever Modiji Brought Budget, Country Has Been Disappointed: Jitu Patwari

- 10:21 (IST) Feb 01

Budget 2025 LIVE Updates: President Murmu Feeds Customary 'Dahi-Cheeni' To FM Sitharaman

- 10:18 (IST) Feb 01

Budget 2025 LIVE Updates: Punjab Demands Special Package For Crop Diversification, MSP Legal Guaranteee

- 10:48 (IST) Feb 01

Budget 2025 LIVE Updates: Sitharaman Poses With Iconic Red 'Bahi Khata' Along With Budget Team

- 10:03 (IST) Feb 01

Budget 2025 LIVE Updates: Sitharaman Arrives In Parliament, To Attend Cabinet Meeting

- 09:50 (IST) Feb 01

Budget 2025 LIVE Updates: Sitharaman Presents Budget Copy To President Murmu

- 09:35 (IST) Feb 01

Budget 2025 LIVE Updates: Sitharaman Wears White Saree In Tribute To Madhubani Padma Awardee

- 09:51 (IST) Feb 01

Budget 2025 LIVE Updates: Share Market Exhibits Major Volatility, Sensex Tests 77,600

- 09:51 (IST) Feb 01

Budget 2025 LIVE Updates: Truckload Of Budget Documents Arrive At Parliament

- 09:14 (IST) Feb 01

Budget 2025 LIVE Updates: Finance Minister Poses With Iconic 'Bahi Khata' Along With Budget Team

- 09:05 (IST) Feb 01

Budget 2025 LIVE: Not Expecting Much For Common People, Budget To Focus On Corporates, Congress Attacks Centre

- 08:59 (IST) Feb 01

Budget 2025 LIVE Updates: NDA Ally JD(U) Expects 'Big Announcement' For Bihar

- 08:56 (IST) Feb 01

Budget 2025 LIVE Updates: FM Sitharaman Reaches Rashtrapati Bhavan, To Present Copy Of Budget To Prez Murmu

- 08:46 (IST) Feb 01

Budget 2025 LIVE: From Rashtrapati Bhavan To Lok Sabha, Here's FM Sitharaman's Schedule For Today

- 08:41 (IST) Feb 01

Budget 2025 LIVE: India Inc Looks For Increased Allocation For Upskilling Initiatives

- 08:35 (IST) Feb 01

Budget 2025 LIVE: Innovation-Driven Policies, Indigenous Manufacturing Needed For India To Achieve $5 Trillion Economy

- 08:25 (IST) Feb 01

Budget 2025 LIVE Updates: MoS Finance Arrives At Ministry, Says 'Everything Will Be Known Before 12 Noon'

- 08:20 (IST) Feb 01

Budget 2025 LIVE Updates: Quick Commerce Sector Expects 'Supportive Regulation' Ensuring Level Playing Field

- 07:53 (IST) Feb 01

Budget 2025 LIVE Updates: Common Man Hopes For Tax Relief Amid Soaring Prices And Stagnant Wage Growth

- 07:50 (IST) Feb 01

Budget 2025 LIVE Updates: Govt Will Continue Focusing On Women, Youth, Farmers And Underprivileged, Expects Godrej CEO

- 07:36 (IST) Feb 01

Budget 2025 LIVE Updates: When And Where To Watch FM Sitharaman's Presentation

- 07:29 (IST) Feb 01

Budget 2025 LIVE Updates: Real Estate Sector Urges Key Reforms To Sustain Growth Trajectory

- 07:23 (IST) Feb 01

Budget 2025 LIVE Updates: India's GDP Growth For FY 26 Falling Short For Achieving Viksit Bharat Target

- 07:12 (IST) Feb 01

Budget 2025 LIVE: Finance Minister Nirmala Sitharaman To Present Budget For Record 8th Time Today

Sectorial Report

Budget Timeline

Personal Corner