Explorer

Advertisement

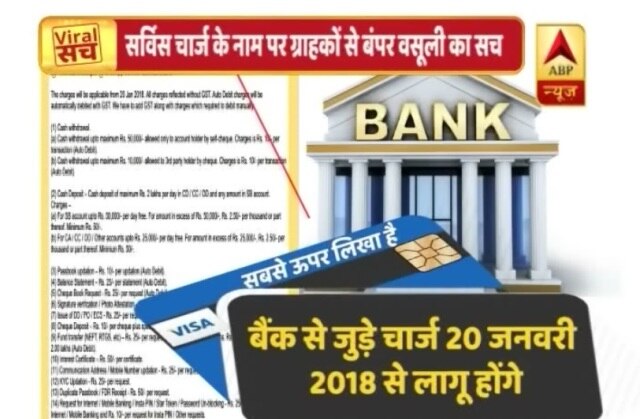

Viral Sach: Banks to impose higher service charges from January 20?

Public and private sector banks in India are going to charge their customers for the services they used to provide free of charge, claimed a message on social media.

Public and private sector banks in India are going to charge their customers for the services they used to provide free of charge, claimed a message on social media.

NEW DELHI: Public and private sector banks in India are going to charge their customers for the services they used to provide free of charge from January 20, claimed a message on social media.

It said if you are to enroll or subscribe to any service, banks would deduct a certain amount from your account automatically.

"The charges will be applicable from 20 January 2018. All charges are reflected without GST. Auto Debit charges will be automatically debited with GST. We have to add GST along with charges which required to debit manually," the message read.

The message provided a long list of bank services along with the 'charges':

- Cash withdrawal up to maximum Rs. 50,000/- allowed only to account holder by self-cheque. Charges: Rs. 10/- per transaction (Auto Debit).

- Cash withdrawal up to maximum Rs. 10,000/- allowed to 3rd party holder by cheque. Charges: Rs. 10/- per transaction (Auto Debit).

- Cash Deposit – Cash deposit of maximum Rs. 2 lakhs per day in CD / CC / OD and any amount in SB account.

- For SB account up to Rs. 50,000/- per day free. For amount in excess of Rs. 50,000/-, Rs. 2.50/- per thousand or part thereof. Minimum Rs. 50/-.

- For CA / CC / OD / Other accounts up to Rs. 25,000/- per day free. For amount in excess of Rs. 25,000/-, Rs. 2.50/- per thousand or part thereof. Minimum Rs. 50/-.

- Passbook updation – Rs. 10/- per updation (Auto Debit).

- Balance Statement – Rs. 25/- per statement (Auto Debit).

- Cheque Book Request - Rs. 25/- per request (Auto Debit).

- Signature verification / Photo Attestation - Rs. 50/- per request.

- Issue of DD / PO / ECS - Rs. 25/- per request (Auto Debit).

- Cheque Deposit – Rs. 10/- per cheque plus speed clearing charges.

- Fund transfer (NEFT, RTGS, etc) – Rs. 25/- per request for an amount up to Rs. 2.00 lakhs. Rs. 50/- for an amount above Rs. 2.00 lakhs (Auto Debit).

- Interest Certificate – Rs. 50/- per certificate.

Follow Breaking News on abp LIVE for more latest stories and trending topics. Watch breaking news and top headlines online on abp News LIVE TV

View More

Advertisement

Advertisement

Advertisement

Top Headline

Election 2024

INDIA AT 2047

Election 2024

India

Advertisement

Trending News

for smartphones

and tablets

and tablets

Anand Kochukudy

Opinion