Explorer

Advertisement

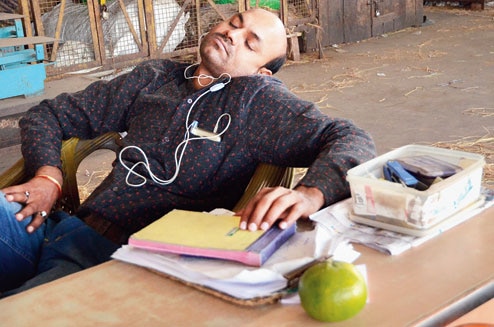

Demonetisation: Slumber fear grips economy

NEW DELHI: The pundits have started to crunch numbers to assess the immediate impact of the Narendra Modi government's demonetisation drive on the economy, businesses and households - and the picture doesn't look too good.

A consensus has started to emerge that the economy will take a hard knock in the short term with GDP growth likely to contract by 0.7 to 1 percentage point over the next year. The maximum impact is likely to be felt in the third and fourth quarters of this financial year.

While the economists quibble over the scale of the macroeconomic impact, there is a growing sense that the cash-dependent sectors of the economy - accounting for around 30 per cent of the GDP - will feel the real heat as money supply contracts sharply.

The big drag on GDP growth is expected to come from the cash crunch in retail trade and related businesses. Consumer durables, real estate, retailing, jewellery, and hotels and restaurants - the wide patch of discretionary spending - will wilt with a potential loss of pricing power.

The informal economy, which some estimate at 45 per cent of the GDP, is expected to stutter over the next few weeks till the government starts to remonetise at least a substantial part of the Rs 14 trillion currency stack that became what Modi called "useless bits of paper" while delivering his shock announcement on the evening of November 8.

"We are staring at a massive downward spiral in the economy," former banker Meera Sanyal said in a televised debate on the virtues of demonetisation. "We have a large and legitimate cash-driven economy that has been massively impacted by the move. And that can only hurt the economy."

"Against the current backdrop, we expect October-December quarter earnings to be impacted the most," brokerage Motilal Oswal said in a report titled Demonetisation: Feedback from the Ground Zero. The brokerage said it was difficult to quantify the earnings impact because of the uncertainty surrounding the duration of liquidity recalibration.

"We believe autos, FMCG, retail, consumer durables, mid-caps, cement, telecom and NBFCs could see earnings downgrades for 2016-17," it added.

The following is the view this newspaper collected from segments such as consumer goods, retailing, trucking, jewellery, cars, petrol outlets, jute, tea and financial services.

Consumer goods

The fast-moving consumer goods (FMCG) makers have been reporting sluggish sales in the first quarter - and the demonetisation drive could further crimp revenue growth numbers.

FMCG companies expect the quarter to be affected, and even see the impact spreading to the next quarter if liquidity issues are not resolved. Sales are down by 40-50 per cent over usual levels, with discretionary items not moving at all.

In the case of consumer durables, reports suggest that sales of white goods and television sets are down by 50 to 60 per cent since the demonetisation. But this may also be a result of the fact that festival season buying has started to peter out with companies not in a position to prolong freebies or cash discounts as most of them have already spent their festive season budgets.

Retailing

Branded apparel sales have been severely impacted this week with a fall in footfalls of over 50 per cent in many outlets across the country.

The industry usually reports that cash transactions account for about 40 per cent of sales. There is no sign that these sales are being converted into credit and debit card payment modes.

Malls are starting to see thin attendance and industry analysts said things could remain bleak for at least two to three months.

But an official of More, the Aditya Birla-owned supermarket brand, said that although sales had been subdued since November 9 in Calcutta, it had registered over 20 per cent growth this week. Reliance Fresh and Spencer's too have witnessed good growth.

"Many of our customers are trying to hoard food items as they are fearing shortages," an official of an outlet said.

Trucking

Fleet utilisation of truckers has plunged by 40 per cent despite the government giving out sops such as allowing petrol pumps to accept old notes, waiving tolls on highways and allowing state agencies collecting taxes and octroi to accept old notes.

S.P. Singh, head of the Indian Foundation of Transport Research and Training, a truckers' body, said: "Of our fleet of 85 lakh heavy trucks, 40 per cent are idling despite a steep drop in truck rentals. We are just not getting customers."

Rentals for a full round trip by a 25-tonne truck have fallen on the Delhi-Calcutta-Delhi route from Rs 93,600 to Rs 72,000, on the Delhi-Hyderabad-Delhi route from Rs 129,400 to Rs 102,000, and on the Delhi-Raipur-Delhi route from Rs 86,900 to Rs 69,500. The fall does not seem to have helped at all.

At an emergency meeting on Thursday, truckers decided to plead with the finance ministry to allow gas stations to accept old notes till November 30 instead of November 24.

The meeting decided to seek an extension of the date till which toll is exempt on highways, which currently stands at November 18. The truckers are expected to appeal to the ministry to consider allowing them to withdraw up to Rs 5 lakh in cash as a special case.

"Normally, a truck crew that goes out on the Delhi-Calcutta-Delhi route is given Rs 30,000 to spend on the way - food, chungi charges (toll tax), emergency repairs. Without this, truck crews just do not want to move," said Ravinder Ahuja, a Delhi-based transporter.

Jewellery

The gold and jewellery trade has taken a big hit with sales down by over 50 per cent in different parts of the country, including Bengal. In some places, shops are shut and storeowners are exploring ways to cut down costs.

According to members of the All India Gems and Jewellery Trade Federation, buyers are not prioritising purchase of jewellery because of the cash crunch.

"The situation is grave. Immediately after the announcement, there was a rush and some jewellers were accepting the old notes. But now most jewellers are not. The wedding season has started, yet many buyers are staying away from the stores," said Bachhraj Bamalwa, a member of the federation.

"Various government departments, including sales tax, income tax and excise, have created panic among jewellers in the name of carrying out enquiries. They are asking us for details such as stock, sales and closing balance on a daily basis. Many jewellers are closing shops out of panic despite not being involved in any illegal activity. This too affected sales of jewellery on and after November 8," said Samar Kumar De, president of the Swarno Shilpo Bachao Committee.

He added that jewellers in Bengal had approached the state government about their plight.

Car sales

Sales of two-wheelers, SUVs and premium vehicles will be significantly affected as these segments transact heavily through cash, especially in the rural markets.

Used-car sales, which too see high cash transactions, are expected to slow down as customers postpone purchase decisions.

"Around 60 per cent of two-wheeler purchases are made through cash while for SUVs, luxury cars and second-hand cars, 30-40 per cent of the deal is done in cash. These segments will see a significant impact," said Abdul Majeed, Partner, PricewaterhouseCoopers.

He added that the effect of the demonetisation would stay till January-end and there might be a small surge in sales in February-March. However, the overall growth in vehicle sales will come down to a single digit for the current fiscal as a consequence of the currency notes ban.

A dealer in used cars said that many people who had cash in old currencies had enquired if they could use them to buy old cars. However, "we have stopped accepting these notes", he said.

"Earlier, the industry growth rate was predicted at 10-15 per cent, but with the twin impact of GST and currency ban, the overall sales will grow in a single digit," said Majeed.

Although the purchases of small and mid-sized cars are being financed through bank loans or paid through cheques, purchase decisions are likely to get postponed as customers grapple with the daily hassles arising out of a shortage of legitimate cash in the system.

"I don't see any big impact on small car sales as a consequence of the currency notes ban. But a lot of people are not too sure about the GST rate structure, definition and cess. So, GST uncertainty may have some impact on small car sales over the next few months," said an executive from a top automaker.

Petrol pumps

A spurt in petrol and diesel sales was recorded in the initial days of demonetisation with people resorting to panic buying. This had resulted in sales zooming by about 45 per cent.

"However, the sales in fuel pumps have normalised. Motorists are bringing Rs 500 and Rs 1,000 notes that have been demonetised. However, banks are refusing to accept the cash as they do not have space to keep them in their chest," said Ajay Bansal, president of the All India Petroleum Dealers Association.

This has created a huge problem as petrol pump dealers cannot keep the cash and do not have safekeeping facilities. "We plan to apprise the authorities of the issue, so that a solution can be worked out. Otherwise, we will have no option but to shut down operations," Bansal added.

Bansal said banks should provide smaller denomination notes worth Rs 50,000 to pump owners daily to avoid unpleasant situations or set up extension counters at petrol pumps to provide change to customers.

Jute

The jute sector disburses a large proportion of its wages in the form of cash. In letters submitted to the Bengal government and the RBI, industry body Indian Jute Mills Association has highlighted the payment crisis in the 60-odd jute mills in the state because of the demonetisation.

Payments of around Rs 250 crore are made in cash to 2.5 lakh workers each month and this has now run into problems, the IJMA letter had said.

Typically, mills make fortnightly payments to workers, with the second payment usually scheduled in the last week of the month. With jute mills frequently shut on account of labour unrest, any payment-related issues will further worsen the situation for the jute industry.

"There are increasing fears of industrial unrest in jute mill areas if the situation lingers beyond November 21, the next scheduled day of fortnightly wage payment," the IJMA letter said.

Tea

Tea garden owners in Assam and Bengal have been writing to the Centre and state governments to relax the cash withdrawal limits as they are unable to pay the workers.

"Labourers are skipping work because of non-payment of wages. Banks here are cash-strapped: every time we ask for money, they say they have run out of cash," said a tea producer.

"Very few garden owners have been able to pay the workers and even if they have, it is mostly with Rs 2,000 notes, which is creating a problem of change," said Ziaur Alam, convener of Joint Forum, an umbrella body of tea workers' unions.

Financial services

The financial services sector could see some big gains in the short term. If 80 per cent of the outstanding stock of Rs 500 and Rs 1,000 notes, valued at over Rs 14 trillion, is brought back into the banking system, banks will see a surge in their deposit base which will spark sharp cuts in lending and deposit rates.

Mobile payments platform Paytm said it had registered over 25 million offline transactions worth over Rs 150 crore in the past nine days. "In Calcutta, offline transactions grew 120 per cent while there was a 338 per cent growth in merchant onboarding," said a Paytm official.Mobikwik too saw a five-fold surge in the transaction value of offline payments while the growth in money added to the wallet was nearly 2,000 per cent. Oxigen Wallets also witnessed a 50 per cent growth in offline transactions.

Reports suggest that M-wallet transactions in value terms have increased 20-fold in the past three years and that demonetisation would give a further fillip to this nascent channel.

Bajaj Finance Limited's EMI (Existing Member Identification) card is also enabling cashless purchase of anything from consumer durables, furniture, apparel, footwear, eyewear or even groceries.

Follow Breaking News on abp LIVE for more latest stories and trending topics. Watch breaking news and top headlines online on abp News LIVE TV

View More

Advertisement

Advertisement

Advertisement

Top Headline

India

Election 2024

Election 2024

Election 2024

Advertisement

Trending News

for smartphones

and tablets

and tablets

Anand Kochukudy

Opinion