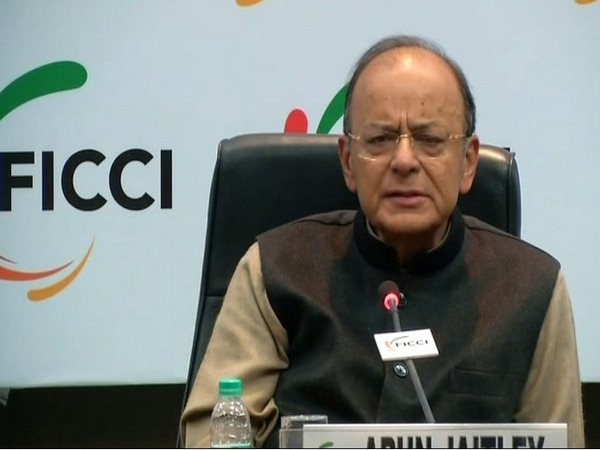

Corporate tax reduction subject to phasing out of exemptions: Jaitley

New Delhi [India], Feb. 05 (ANI): Amid the numerous debates regarding the reduction of corporate income tax, Finance Minister Arun Jaitley said it would be possible only when exemptions phase out.

Jaitley, while addressing a post-budget meeting with senior officials of the Federation of Indian Chambers of Commerce and Industry (FICCI), said the economy's potential would increase only when the exemptions fade off, thereby providing legroom for the reduction of corporate tax.

"In 2015, I had promised to cut corporate tax rate to 25 per cent, from 30 per cent, in four years. Indian companies need to have investible surplus. However, a reduction needs to be accompanied by phasing out of exemptions, as they cannot be easily written off. It is not appropriate to end exemptions midway, as some industries may have been set up based on them. Therefore, any reduction would involve the end of all exemptions," he said.

With regards to the remaining 7,000 companies outside of the 25 percent tax bracket, Jaitley noted that the average effective tax rate after considering the exemptions stands at around 22 per cent.

Earlier in the day, Finance Secretary Hasmukh Adhia said the Centre would bring down its corporate income tax rate, once they witness a surge in the personal income tax collections.

"When it comes to the demand for reduction in the corporate income tax rate, we are not denying the claim that yes we should bring down the overall corporate income tax rate in India. But, the present balance, what is happening in most of the countries is that personal income tax is much higher compared to corporate income tax. While in India, the other side has to go up. Once that goes up, then we will have some more scope for reduction," Adhia said while speaking at a session organised by the Confederation of Indian Industries (CII) here.

On a related note, the finance minister while presenting the Union Budget 2018-19 on Thursday proposed to cut corporate income tax rate to 25 percent for companies with a turnover of up to Rs. 250 crore, with no changes in the income tax rates and slabs. (ANI)

This story has not been edited. It has been published as provided by ANI

Top Headline

Trending News

and tablets